Technology

WBTC (Wrapped Bitcoin)

Introduction to Wrapped Bitcoin (WBTC)

Wrapped Bitcoin (WBTC) is an ERC-20 token that represents Bitcoin (BTC) on the Ethereum blockchain. Each WBTC token is backed 1:1 by Bitcoin, meaning that for every WBTC in circulation, there is an equivalent amount of Bitcoin held in reserve by a custodian. This integration brings the liquidity and stability of Bitcoin to the Ethereum ecosystem, enabling users to leverage Bitcoin in decentralized applications (dApps), decentralized finance (DeFi) protocols, and other blockchain-based functionalities.

Origin and Development

Wrapped Bitcoin was officially launched on January 31, 2019, as a collaborative project between multiple organizations, including BitGo, Ren, and Kyber Network. These organizations form the WBTC DAO (Decentralized Autonomous Organization), which governs the protocol and ensures the peg between WBTC and BTC remains intact.

Technical Architecture

1. ERC-20 Standard:

WBTC is an ERC-20 token, meaning it adheres to the standard defined for tokens on the Ethereum blockchain. This ensures compatibility with all Ethereum-based wallets, dApps, and smart contracts.

2. Custodians and Minting:

The custodian, primarily BitGo, is responsible for holding the Bitcoin reserves. To mint new WBTC, a user must undergo a KYC/AML verification process through an approved merchant.

After verification, the user sends Bitcoin to the custodian, who then mints an equivalent amount of WBTC and sends it to the user’s Ethereum address.

3. Burn and Redeem:

When a user wants to convert WBTC back into Bitcoin, they must send WBTC to a merchant who then initiates the burn process. The custodian releases the equivalent amount of Bitcoin to the user’s Bitcoin address.

Key Features and Benefits

1. Liquidity:

WBTC brings the liquidity of Bitcoin to the Ethereum ecosystem. This is particularly beneficial for DeFi platforms that require high liquidity for lending, borrowing, and trading activities.

2. Interoperability:

By bridging Bitcoin and Ethereum, WBTC allows Bitcoin holders to participate in the Ethereum ecosystem without having to sell their BTC.

3. Transparency:

The reserves backing WBTC are verifiable through the blockchain. BitGo provides regular audits and proof of reserves, ensuring that each WBTC is fully backed by an equivalent amount of Bitcoin.

4. Speed and Efficiency:

Transactions involving WBTC are processed on the Ethereum blockchain, which generally offers faster confirmation times compared to the Bitcoin network. Additionally, Ethereum’s smart contract functionality enables more complex interactions and automated processes.

Use Cases

1. DeFi Applications:

WBTC can be used as collateral in lending and borrowing platforms like Compound and Aave, or in liquidity pools on decentralized exchanges (DEXs) like Uniswap and SushiSwap.

2. Trading:

Traders can use WBTC to gain exposure to Bitcoin’s price movements without leaving the Ethereum ecosystem. It also allows for arbitrage opportunities between centralized exchanges and DEXs.

3. Yield Farming:

Users can stake their WBTC in various DeFi protocols to earn rewards, participate in liquidity mining, and generate passive income.

4. Payment and Transfers:

WBTC facilitates faster and cheaper transfers of Bitcoin value across the Ethereum network, leveraging Ethereum’s relatively lower transaction fees and faster block times.

Risks and Challenges

1. Centralization:

One of the main criticisms of WBTC is its reliance on centralized custodians. While the custodians are reputable entities, this centralization introduces counterparty risk.

2. Regulatory Risks:

As with all cryptocurrencies, WBTC faces potential regulatory scrutiny. Compliance with KYC/AML regulations may deter some users who prioritize privacy and decentralization.

3. Smart Contract Risks:

WBTC relies on Ethereum smart contracts, which are susceptible to bugs and exploits. While audits and security measures are in place, the risk of vulnerabilities cannot be entirely eliminated.

4. Custodial Risk:

The security and integrity of the custodian (BitGo) are paramount. Any compromise of BitGo’s operations or custodial practices could impact the WBTC peg and user funds.

Governance and Community

The governance of WBTC is managed by the WBTC DAO, which consists of various members from prominent organizations within the crypto space. The DAO structure allows for decentralized decision-making and community involvement in the evolution of the WBTC protocol.

Market Performance and Adoption

Since its inception, WBTC has seen significant adoption and integration across numerous DeFi platforms and exchanges. It has become one of the most widely used Bitcoin representations on the Ethereum network, with substantial trading volumes and liquidity.

Competitors and Alternatives

While WBTC is a leading tokenized Bitcoin, there are other alternatives in the market, including:

RenBTC: Another ERC-20 token backed 1:1 by Bitcoin, created by the Ren Project.

HBTC: An ERC-20 token backed by Bitcoin, issued by Huobi.

tBTC: A decentralized solution for tokenizing Bitcoin on Ethereum, focusing on trustless minting and redeeming processes.

Future Prospects

The future of WBTC looks promising, with continuous growth in the DeFi sector driving demand for tokenized Bitcoin. Potential developments include:

Enhanced interoperability with other blockchain networks.

Increased adoption in traditional finance as the cryptocurrency market matures.

Improvements in governance and decentralization to mitigate centralization risks.

Conclusion

Wrapped Bitcoin (WBTC) represents a significant innovation in the cryptocurrency space, merging the value and liquidity of Bitcoin with the versatile and robust Ethereum ecosystem. While it offers numerous benefits for DeFi users and traders, it also comes with inherent risks, particularly related to centralization and custodial dependencies. As the cryptocurrency landscape evolves, WBTC is likely to play a crucial role in bridging different blockchain networks and expanding the utility of Bitcoin across various applications

Technology

Tesla Succession Planning: Musk Faces Challenges Ahead

Tesla succession planning has taken center stage as the company faces significant challenges under the leadership of Elon Musk.Recent reports indicate that Tesla’s board has initiated a discreet search for Musk’s potential successor amid declining sales, worrisome market value drops, and escalating concerns from shareholders.

Tesla succession planning has taken center stage as the company faces significant challenges under the leadership of Elon Musk. Recent reports indicate that Tesla’s board has initiated a discreet search for Musk’s potential successor amid declining sales, worrisome market value drops, and escalating concerns from shareholders. The need for effective succession planning in such a high-profile company is exacerbated by Musk’s divided attention, as he balances corporate responsibilities with his political engagements. The current state of Tesla board news reveals that executives are actively reaching out to executive search firms, signaling a proactive approach to secure the company’s future leadership. With Tesla’s market valuation swinging dramatically from $1.5 trillion to approximately $900 billion, the urgency behind these discussions is evident, highlighting the crucial nature of a well-thought-out succession plan for sustainable growth.

The ongoing preparations for future leadership at Tesla, often referred to as succession management, spotlight the considerations surrounding Elon Musk’s eventual departure from his role. As the electric vehicle manufacturer grapples with issues like sales downturns and investor anxieties, understanding the impact of robust executive planning becomes increasingly vital. The developments within the Tesla leadership ecosystem come at a time when the company’s valuation is under pressure, raising questions about how new executives might steer the brand during turbulent times. Furthermore, as discussions about potential candidates intensify, the importance of transitioning smoothly to new leadership cannot be understated. Engaging in a thorough search for a Musk successor is not just about maintaining stability; it’s also about positioning Tesla for future success.

Frequently Asked Questions

What is Tesla’s succession planning for Elon Musk’s successor?

Tesla’s succession planning for Elon Musk’s successor has recently become a point of focus as the company faces rising challenges. Reports indicate that Tesla’s board has engaged executive search firms to identify potential candidates to succeed Musk as concerns grow about his divided attention between Tesla and his political engagements. This proactive measure reflects the board’s commitment to ensuring strong leadership amidst a backdrop of declining sales and shrinking profits.

How is the Tesla board managing the search for Elon Musk’s successor?

The Tesla board is managing the search for Elon Musk’s successor by initiating discussions with executive search firms. This decision comes after expressing concerns to Musk regarding his involvement in political matters, which may distract him from Tesla’s needs. The board aims to ensure that Tesla is prepared for future leadership transitions while addressing current challenges the company faces, including a significant sales decline.

What impact has Elon Musk’s involvement in politics had on Tesla and its succession planning?

Elon Musk’s involvement in politics has negatively affected Tesla, leading to the company’s first annual sales decline in over a decade. This involvement, coupled with declining profits, has prompted the board to reconsider succession planning. The search for Musk’s successor is part of a broader strategy to safeguard the company’s leadership and maintain its market value, which has dropped significantly as a result of these challenges.

Why is Tesla’s market value declining amidst succession planning?

Tesla’s market value has been declining due to a combination of factors, including significant sales drops and public perception issues stemming from Elon Musk’s political activities. As the board initiates succession planning for Musk, these financial difficulties pose a challenge. The decline in profitability and overall market value emphasizes the urgency for effective leadership and strategic direction to stabilize Tesla’s performance.

Are there concerns regarding Tesla’s executive search due to declining sales?

Yes, there are significant concerns regarding Tesla’s executive search due to its declining sales. The board’s decision to look for a successor to Elon Musk signals their recognition of the need for stable leadership as Tesla navigates these tough financial waters. The recent drop in profits and revenue highlights the critical nature of finding a suitable new leader who can guide Tesla through its current challenges.

What challenges is Tesla facing that may affect succession planning?

Tesla is currently facing several challenges affecting its succession planning, including a steep decline in sales, shrinking profits, and a tarnished brand image due to Elon Musk’s political affiliations. The board’s search for Musk’s successor reflects the urgency to address these issues and ensure effective leadership. This proactive approach aims to stabilize the company amidst these obstacles and prepare for a future transition.

How does the Tesla board view Elon Musk’s commitment to the company during succession planning?

The Tesla board views Elon Musk’s commitment to the company with caution during their succession planning discussions. Although Musk has assured the board he will allocate more time to Tesla, concerns over his divided attention due to outside interests remain. These discussions are crucial as the board prepares for potential leadership changes while navigating the challenges posed by declining sales and profits.

| Key Point | Details |

|---|---|

| Tesla’s Board’s Actions | The board has begun searching for a potential successor to Elon Musk. |

| Concerns Over Musk’s Focus | Board members have expressed concerns over Musk’s divided attention due to his government involvement. |

| Sales and Profit Decline | Tesla experienced its first annual sales decline in over a decade, with a 71% decrease in profits. |

| Market Value Drop | Tesla’s market value fell from $1.5 trillion to around $900 billion. |

| Musk’s Commitment to Tesla | Musk promised to dedicate more time to Tesla, stating he would allocate more of his time starting May. |

| Uncertainty of Succession Planning | It remains unclear whether Musk is aware of the succession planning efforts. |

Summary

Tesla succession planning is currently at the forefront of discussions, as the company’s board has initiated a search for a successor to Elon Musk amidst growing concerns over his divided focus. The challenges Tesla is facing, including declining sales and profits, have prompted board members to take proactive measures in ensuring the automaker’s future stability. With Musk’s political commitments affecting his role at Tesla, the need for a well-structured succession plan has become more pressing, highlighting potential changes needed for the company’s leadership strategy.

Understanding Tesla’s Succession Planning Process

As Tesla navigates a volatile market landscape, the need for strategic succession planning has never been more pronounced. The Tesla board’s initiative to search for a potential successor to Elon Musk marks a pivotal moment in the company’s journey. By engaging executive search firms, they are showing an awareness of the risks posed by Musk’s split focus on both Tesla and political engagements. This proactive approach not only showcases their commitment to the company’s future but also speaks to shareholders who are concerned about the direct implications of Musk’s divided attention on Tesla’s innovation and market position.

Moreover, the succession planning process is crucial for reinforcing investor confidence amid a backdrop of declining sales and profits. With Tesla’s market value taking a significant hit—from $1.5 trillion to approximately $900 billion—it is essential for the board to identify a leader who can navigate the challenges ahead. Although reports indicate that Musk is currently committed to focusing more on Tesla, the underlying dynamics of his involvement in broader political issues create uncertainty. Therefore, having a well-conceived succession strategy ensures that the company is not overly reliant on one individual, thereby safeguarding its long-term viability.

Impact of Elon Musk’s Leadership on Tesla’s Market Value

Elon Musk’s leadership has undeniably transformed Tesla into a giant in the automotive and tech industries. However, the recent downturn in Tesla’s market value prompts us to examine the implications of his heavy involvement in government affairs. Musk’s participation in shaping fiscal policies has garnered praise from certain quarters, but it has also raised eyebrows among stakeholders concerned with the company’s direction. As Tesla’s annual sales recently experienced their first decline in over a decade, many in the industry begin to question whether Musk’s focus is yielding the performance needed to maintain Tesla’s high market valuation.

Additionally, the effects of this focus on market trends and brand perception cannot be understated. As Musk’s political affiliations appear to alienate some consumers, Tesla’s brand image may suffer collateral damage. This shift complicates the board’s challenge, as they strategize on navigating public sentiment while reinforcing the brand’s market proposition. The hunt for a successor is, therefore, not merely about finding someone to step into Musk’s shoes but identifying a leader who can unite the public and drive rapid growth, especially during challenging market scenarios.

Challenges Facing Tesla in the Wake of Sales Declines

The impact of declining sales on Tesla is multifaceted, affecting not just its profitability but also its overall market presence. A recent report revealed a staggering 71% drop in profits paired with a 9% decrease in revenue—these metrics traditionally suggest a company in crisis. Shareholders, anxious about the trajectory of their investments, look to the board for reassurance that Tesla can return to its peak performance. As protests against Musk’s policies compound the challenges stemming from reduced sales, it is clear that Tesla is at a crossroads.

This adversity underscores the urgency for effective leadership transition and strategic foresight. Without addressing the root causes of these declines—especially in the context of Musk’s dual role as a corporate and political figure—Tesla risks losing its footing in an increasingly competitive marketplace. The Tesla board, amid its succession planning discussions, must align its strategies to tackle these operational challenges head-on while ensuring that the next leader can effectively navigate both internal dynamics and public perception.

The Future of Tesla: Leadership Transitions and Expectations

As Tesla’s board embarks on the journey of potential leadership transition, the expectations from both stakeholders and market analysts are substantial. With a founder like Elon Musk at the helm, known for his visionary approach and sometimes controversial decisions, the next leader will face immense scrutiny. Stakeholders not only seek someone who can maintain Tesla’s innovative drive but also manage public relations effectively, especially in light of recent controversies surrounding Musk’s governance style.

Moreover, the executive search process should be strategic and well-communicated. Transparency about the qualities and qualifications sought in Musk’s successor can further help alleviate anxieties among investors. As Tesla has faced a decline in its market value and a turbulent political landscape, a diversified leadership approach may provide the stability needed to instill confidence moving forward. The roadmap to recovery hinges upon the board’s ability to articulate a clear vision for Tesla’s future, alongside its succession planning endeavors.

The Role of Tesla’s Board in Executive Search

The Tesla board plays a fundamental role in shaping the future of the company by engaging in thoughtful executive searches. The decision to explore the possibility of a successor for Elon Musk reflects a strategic approach to governance, aimed at ensuring the sustainability of Tesla amid rising challenges. Board members have understood the necessity of having a robust plan to attract leadership talent capable of navigating an unpredictable automotive market and achieving revenue targets. In doing so, they enhance the credibility of the board’s stewardship in the eyes of investors and market analysts alike.

Additionally, the executive search process is not merely about identifying potential candidates but also about assessing the internal dynamics that affect Tesla’s corporate culture and operational strategy. As candidates are evaluated, the alignment with Tesla’s core values and vision is paramount. The board must consider candidates who can not only lead but also inspire innovation while effectively managing the company’s public image to counteract any potential fallout from Musk’s political endeavors. Ultimately, a focused and deliberate approach in executive search will be crucial to revitalizing Tesla’s brand and market presence.

Tesla’s Strategic Direction Post-Musk

Looking ahead, the question of Tesla’s strategic direction post-Musk is critical for understanding potential shifts in the company’s operations and market approach. As reports surface about an aggressive search for a successor, the need for a seamless transition comes into sharp relief. The new leader must carry forward Musk’s vision while also bringing fresh perspectives that align with current market realities. Analysts suggest that embracing change through innovative leadership is essential for Tesla to thrive in the face of intensifying competition from both traditional automakers and new entrants in the electric vehicle space.

Moreover, the new leadership must be adept at addressing the challenges that have impacted Tesla’s sales and overall perception. With a keen awareness of the shifting consumer sentiment towards electric vehicles, the next CEO will also need to uphold Tesla’s reputation for groundbreaking technology and sustainability. By setting a clear strategic direction that prioritizes growth while addressing past missteps, the new leadership can restore confidence among investors and consumers. This transition period is therefore not just a repositioning of roles but an opportunity to redefine Tesla’s future in the global market.

Investor Sentiment and Executive Search Initiatives

Investor sentiment plays a pivotal role in the context of Tesla’s executive search initiatives. As Tesla navigates challenging times marked by sales declines and profit reductions, stakeholders are watching the board’s actions closely. The approval of executive search firms for potential successors to Elon Musk serves as both a reassurance and a signal to investors that the company is committed to long-term stability and performance. Investors, understandably anxious about market volatility, look for signs that the board is actively managing succession planning to mitigate risks and enhance shareholder value.

Furthermore, addressing investor concerns is crucial as Tesla’s market reputation hinges on leadership effectiveness. The board’s ability to articulate a coherent strategy during the executive search process will reassure stakeholders that Tesla is poised for recovery. Clear communication about the qualities sought in Musk’s successor, alongside regular updates on the progress of the search, will help in maintaining investor confidence—an essential aspect in navigating this tumultuous period for the company.

Restoring Tesla’s Brand Image Amidst Political Controversies

As political controversies surrounding Elon Musk’s public persona increasingly affect Tesla’s brand image, the company faces a formidable challenge to restore its reputation. With recent protests and backlash from certain consumer groups, it becomes imperative for Tesla to engage in active brand recalibration. The appointment of a successor capable of distancing the operational strategy from Musk’s political affiliations could be one effective approach to reinforce brand integrity and customer loyalty. Addressing the fallout from these controversies will produce a more positive and inclusive brand narrative.

In conjunction with appointing new leadership, Tesla’s marketing and public relations strategies must be finely tuned to resonate with evolving consumer expectations. A successor with a strong background in corporate communications could effectively manage this transition by promoting Tesla’s commitment to innovation and sustainability—qualities that have long been at the heart of the brand. In navigating the turbulent waters of public perception, Tesla’s success in restoring its brand image will largely depend on the new CEO’s ability to rebuild trust among consumers and stakeholders alike.

Navigating Competition Through Strategic Leadership Decisions

As Tesla faces a growing number of competitors in the electric vehicle market, establishing strategic leadership decisions is paramount for maintaining a competitive edge. The board’s current exploration of potential successors to Elon Musk should incorporate an understanding of the competitive landscape, especially as new players emerge with aggressive market strategies. A leader who not only embraces Tesla’s history of innovation but also adapts to market pressures will be key in solidifying the company’s position among competitors. This involves an insightful evaluation of market trends and consumer preferences.

Moreover, the next leader must enhance Tesla’s operational efficiency and ensure product offerings align with consumer demand. As the automotive industry evolves, the ability to pivot and respond effectively to market changes will dictate Tesla’s ability to attract and retain customers. Strategic decisions made during this period—including leadership selection—will shape Tesla’s trajectory in a dynamic environment. Effective leadership will enable the company to harness its strengths while effectively countering competitive threats, ultimately leading Tesla to regain its performance trajectory.

Technology

Microsoft Phi 4 AI: Redefining AI Capabilities

Microsoft Phi 4 AI has emerged as a groundbreaking advancement in artificial intelligence, designed to tackle complex problem-solving across various domains.Unveiled on April 30, 2025, this formidable model series includes Phi 4 mini reasoning, Phi 4 reasoning, and Phi 4 reasoning plus, each pushing the boundaries of what is possible in AI model comparison.

Microsoft Phi 4 AI has emerged as a groundbreaking advancement in artificial intelligence, designed to tackle complex problem-solving across various domains. Unveiled on April 30, 2025, this formidable model series includes Phi 4 mini reasoning, Phi 4 reasoning, and Phi 4 reasoning plus, each pushing the boundaries of what is possible in AI model comparison. Unlike its predecessors, Microsoft Phi 4 AI focuses on providing robust reasoning capabilities while dedicating increased efforts to fact-checking, distinguishing itself in a crowded market. With the Phi 4 mini reasoning model featuring approximately 3.8 billion parameters and tailored for educational applications, and the more powerful Phi 4 reasoning model boasting 14 billion parameters, Microsoft is clearly leading the charge in AI advancements. As these models become accessible on platforms like Hugging Face, the potential for enhanced learning and problem-solving in various fields, from math to coding, is at the fingertips of developers and educators alike.

The recent launch of Microsoft’s Phi 4 AI signifies a notable milestone in the evolution of intelligent systems. This sophisticated lineup of AI models, which includes variants like Phi 4 mini reasoning and the more comprehensive Phi 4 reasoning plus, demonstrates advanced reasoning skills aimed at addressing intricate challenges. Designed with a focus on enhancing educational experiences and ensuring data accuracy, these innovations embody the latest in technology-driven solutions. By employing techniques such as reinforcement learning and high-quality data sourcing, Microsoft is not only competing with other leading AI entities but also redefining the standards of performance and adaptability in the field. As AI continues to evolve, the promise of effective reasoning capabilities at a reduced scale opens new doors for creators and learners in the digital landscape.

Frequently Asked Questions

What is Microsoft Phi 4 AI and how does it compare with other AI models?

Microsoft Phi 4 AI is the latest AI model launched by Microsoft, characterized by its complex problem-solving capabilities. It competes with larger models like OpenAI’s o3-mini, showing impressive performance across various benchmarks. The Phi series includes three variants: Phi 4 mini reasoning, Phi 4 reasoning, and Phi 4 reasoning plus, each designed for different applications and leveraging advanced techniques for improved reasoning.

How does the Phi 4 mini reasoning model work for educational applications?

The Phi 4 mini reasoning model, part of Microsoft Phi 4 AI, is optimized for educational applications, such as tutoring on lightweight devices. With approximately 3.8 billion parameters, it has been trained on nearly 1 million synthetic math problems, making it particularly adept at handling educational tasks while focusing on fact-checking and accuracy.

What advancements does the Phi 4 reasoning model bring in terms of performance?

The Phi 4 reasoning model is equipped with 14 billion parameters and showcases significant advancements by utilizing high-quality web data and curated demonstrations from OpenAI’s o3-mini. This model proves beneficial in math, science, and coding fields, addressing complex problems with enhanced reasoning capabilities compared to earlier models.

What distinguishes the Phi 4 reasoning plus model from the other Phi 4 models?

The Phi 4 reasoning plus model is an adaptation of the original Phi 4, designed to enhance accuracy for specific tasks. It is reported to approach the performance of larger models like R1, which has 671 billion parameters, showcasing Microsoft’s commitment to delivering high performance in AI reasoning while maintaining a manageable model size.

Where can I access Microsoft Phi 4 AI models and technical reports?

All three models of Microsoft Phi 4 AI—Phi 4 mini reasoning, Phi 4 reasoning, and Phi 4 reasoning plus—are available on the Hugging Face AI development platform along with comprehensive technical reports. This accessibility allows developers and researchers to explore and integrate these AI advancements into their applications.

How does Microsoft ensure the performance of Phi 4 models in resource-limited environments?

Microsoft ensures the performance of Phi 4 models in resource-limited environments through a combination of distillation, reinforcement learning, and high-quality data. This approach enables the models to maintain efficiency without compromising on their ability to solve complex reasoning tasks effectively.

What role does fact-checking play in the Phi 4 AI reasoning models?

Fact-checking plays a crucial role in the Microsoft Phi 4 AI reasoning models, allowing them to allocate more time to verify the accuracy of information. This focus enhances their reliability and performance, particularly in applications where precision is essential for complex problem-solving.

| Model Name | Parameters | Training Data | Key Applications | Performance Insights |

|---|---|---|---|---|

| Phi 4 mini reasoning | 3.8 billion | Synthetic math problems from DeepSeek | Educational applications | Targets lightweight devices for tutoring |

| Phi 4 reasoning | 14 billion | Web data and curated demonstrations from o3-mini | Math, science, and coding | Utilizes high-quality data for effective problem-solving |

| Phi 4 reasoning plus | Enhanced from Phi 4 | Adapted for improved accuracy | Specific tasks | Approaches R1’s performance levels |

Summary

Microsoft Phi 4 AI represents a groundbreaking advancement in artificial intelligence, showcasing enhanced capabilities that allow for effective reasoning in smaller devices. Launched on April 30, 2025, thePhi series includes three distinct models optimized for various applications. The Phi 4 mini reasoning focuses on educational tools, while the Phi 4 reasoning excels in math and science tasks, and the Phi 4 reasoning plus aims for top-level performance. These models, benefiting from a blend of innovative training techniques and extensive datasets, are positioned to be competitive against larger models, demonstrating Microsoft’s commitment to pushing the boundaries of AI technology in accessible formats.

Introduction to Microsoft’s Phi 4 AI Model

Microsoft’s Phi 4 AI model, unveiled on April 30, 2025, stands as a testament to the company’s commitment to advancing artificial intelligence technology. The Phi series introduces three distinct models: Phi 4 mini reasoning, Phi 4 reasoning, and Phi 4 reasoning plus, each designed with unique capabilities tailored to solve complex problems efficiently. With the competitive landscape in AI models intensifying, Microsoft’s latest offerings are positioned to not only rival larger counterparts like OpenAI’s o3-mini but also excel in niche applications such as education and coding.

The Phi 4 models leverage advanced training techniques, emphasizing fact-checking and data quality, which enhances their effectiveness for various real-world applications. This focus on rigorous model training and large-scale deployment is pivotal as businesses and educational institutions increasingly rely on AI technologies for support in intricate problem-solving tasks.

Deep Dive into Phi 4 Mini Reasoning

The Phi 4 mini reasoning model boasts approximately 3.8 billion parameters and is specifically engineered for educational applications. Its training on nearly one million synthetic math problems generated by DeepSeek’s R1 model establishes a strong foundation in mathematical reasoning and tutoring capabilities. With its enhanced capabilities, this model is particularly suited for lightweight devices that require a compact and efficient AI structure, making it an excellent choice for mobile learning environments.

By harnessing the power of the Phi 4 mini reasoning model, educators can provide personalized tutoring experiences that adapt to students’ learning speeds and styles. This approach not only facilitates deeper understanding of complex mathematical concepts but also promotes engagement in educational settings where traditional methods may fall short.

Understanding Phi 4 Reasoning Capabilities

Phi 4 reasoning takes a step further with its robust architecture of 14 billion parameters, designed to handle a wider array of tasks ranging from science to coding. By integrating high-quality web data along with curated demonstrations from OpenAI’s o3-mini, this model significantly enhances its applicability in diverse fields. Its performance on educational tasks makes it a valuable tool for students and professionals alike seeking assistance in understanding complex scientific principles.

The versatility of the Phi 4 reasoning model highlights its role not only in academia but also in professional settings where precision and reliability are paramount. Its ability to simplify complex information and offer insights ensures that users can tackle challenging subjects with greater confidence.

The Evolution of Phi 4 Reasoning Plus

The Phi 4 reasoning plus model represents an evolution in Microsoft’s AI strategy, aiming for enhanced accuracy and performance tailored to specific tasks. This model is reportedly closing the gap with significantly larger AI models, such as R1, which boasts an impressive parameter count of 671 billion. Such advancements position the Phi 4 reasoning plus as a formidable contender in the AI landscape, especially for applications requiring high-precision outputs.

By integrating distillation techniques and leveraging reinforcement learning, Microsoft has crafted a model that balances performance with resource efficiency. The Phi 4 reasoning plus is set to revolutionize sectors that demand both high computational power and the ability to function within resource-limited settings, making sophisticated AI accessible to a broader audience.

Benchmarking Against Competitors: Microsoft AI Advancements

In a competitive field dominated by heavyweight AI models like OpenAI’s o3-mini, Microsoft’s strategy of benchmarking the Phi 4 models against these leading systems showcases their commitment to excellence. The OmniMath test serves as a pivotal assessment, ensuring that the Phi 4 models not only match but exceed expectations in various AI applications. This competitive analysis highlights the robustness of Microsoft’s AI advancements and their dedication to providing high-quality tools.

Moreover, these benchmarks emphasize the importance of continuous improvement and innovation in AI development. By setting ambitious performance goals, Microsoft ensures that its users benefit from cutting-edge advancements that keep pace with, or surpass, other leading AI models in the marketplace.

Complex Problem-Solving with Phi 4 Models

The ability of the Phi 4 models to engage in complex problem-solving tasks marks a significant advancement in AI capabilities. Through enhanced fact-checking processes and a focus on higher quality training data, these models equip users with the tools necessary to tackle intricate challenges across various domains. Such capabilities are particularly valuable in fields that require detailed analysis and precision, such as engineering, programming, and scientific research.

As organizations look for AI solutions that can streamline processes and enhance productivity, the Phi 4 series presents a compelling option. By integrating these models into daily operations, businesses can unlock new levels of efficiency in problem-solving, leading to better decision-making and innovative solutions that address their unique needs.

Applications Across Various Industries

Microsoft’s Phi 4 AI models have vast potential applications across multiple industries, from education and healthcare to finance and technology. In education, the Phi 4 mini reasoning model can facilitate personalized learning experiences, adapting to the needs of individual students. In healthcare, the Phi 4 reasoning model can analyze complex datasets, assisting professionals in diagnostics and treatment plans.

Furthermore, in the finance sector, leveraging the Phi 4 reasoning plus model can enhance decision-making processes by providing accurate financial forecasts and risk assessments. This versatility demonstrates how Microsoft AI advancements are instrumental in driving innovation across diverse fields, making sophisticated AI tools accessible and beneficial for organizations of all sizes.

Leveraging Hugging Face for Development

The availability of the Phi 4 models on the Hugging Face AI development platform represents a critical step towards democratizing access to advanced AI technologies. Developers and researchers can leverage this platform to experiment with the models, customize their applications, and share their findings with the community. This open-source environment fosters collaboration and innovation, accelerating the adoption of AI solutions in various sectors.

By providing detailed technical reports alongside the models, Microsoft encourages a deeper understanding of the underlying technologies. This transparency within the development community helps users maximize the potential of the Phi 4 models, driving more significant breakthroughs in AI research and application.

The Future of AI with Microsoft’s Phi Series

The future of AI looks promising with the introduction of Microsoft’s Phi series. As AI continues to evolve, these models are expected to play a crucial role in shaping the next generation of intelligent applications. The inherent adaptability of the Phi 4 models suggests their capability to continually improve, learning from new data and user interactions, thereby enhancing their performance over time.

Looking ahead, it is clear that Microsoft’s investment in research and development of the Phi models will pave the way for further advancements, focusing not only on increasing model size but on improving performance, reliability, and accessibility. As these technologies advance, they are poised to unlock new opportunities and transform the landscape of AI solutions, driving innovation across various sectors.

Technology

Mobile Verification Device: Sam Altman’s Orb Mini Launch

In an era where the lines between human and AI are increasingly blurred, the newly launched mobile verification device is set to revolutionize digital interactions.Developed by Tools for Humanity, the device showcases cutting-edge technology spearheaded by Sam Altman, aiming to provide a clear distinction between humans and artificial agents online.

In an era where the lines between human and AI are increasingly blurred, the newly launched mobile verification device is set to revolutionize digital interactions. Developed by Tools for Humanity, the device showcases cutting-edge technology spearheaded by Sam Altman, aiming to provide a clear distinction between humans and artificial agents online. The Orb Mini, as it’s called, features advanced biometric scanning capabilities, allowing users to confirm their identity through a simple eyeball scan. This initiative is part of Altman’s larger vision, which includes the World project aimed at preventing AI-generated deception on the internet. With growing attention on AI human verification, innovations like the Orb Mini contribute significantly to establishing trust in an ever-evolving digital landscape, paving the way for future advancements in technology and security.

Stepping into the future of digital security, the introduction of a portable human verification gadget highlights the urgent need for reliable identification tools amidst the rise of artificial intelligence. This innovative mobile device, crafted by the pioneering startup Tools for Humanity and co-founded by tech leader Sam Altman, aims to ensure that online users can easily differentiate themselves from AI counterparts. Also referred to as biometric verification devices, these tools utilize sophisticated scanning methods to authenticate human identity, showcasing how technology can serve as a safeguard in a digital ecosystem increasingly populated by synthetic agents. As society grapples with issues of trust and authenticity, such devices become invaluable in maintaining human oversight over emerging AI technologies. Altman’s ongoing commitment to developing these verification solutions reflects the significant role they will play in shaping future interactions in both virtual and real-world environments.

Frequently Asked Questions

What is the purpose of the mobile verification device, Orb Mini?

The Orb Mini, developed by Tools for Humanity, is a mobile verification device designed to discern between humans and AI agents. By scanning users’ eyeballs, it provides a unique blockchain identifier, confirming an individual’s humanity in the digital realm.

How does the Orb Mini from Tools for Humanity ensure human verification?

The Orb Mini uses advanced technology featuring dual front-facing cameras to scan and analyze users’ eyeballs. This process ensures accurate human verification by creating a unique digital identifier, thus tackling the challenge of distinguishing AI from humans online.

Who co-founded the World project and the mobile verification device initiative?

The World project and the development of the mobile verification device, Orb Mini, were co-founded by Sam Altman, CEO of OpenAI, and Alex Blania. This initiative aims to establish a reliable framework for human verification amidst the increasing capabilities of AI.

Where can I get my eyeball scanned with the Orb Mini for verification?

You can have your eyeball scanned with the Orb Mini at designated storefronts across the U.S. in cities like Austin, Atlanta, Los Angeles, Miami, Nashville, and San Francisco, as part of Tools for Humanity’s effort to expand its mobile verification services.

What influence does Sam Altman have on the mobile verification technology space?

Sam Altman, as co-founder of the World project and the mobile verification device initiative, plays a pivotal role in shaping technologies that address human verification challenges in the digital era, moving beyond traditional identity verification to advance AI human verification solutions.

Can the Orb Mini be used for functions other than verification?

While the main function of the Orb Mini is for human verification, the device’s ultimate capabilities remain uncertain. Currently, it is primarily designed to verify individuals rather than serve as a typical smartphone for calling or messaging.

What advancements in AI human verification does the mobile verification device represent?

The Orb Mini signifies a significant advancement in AI human verification by providing a robust, portable solution for individuals to confirm their humanity digitally. This technology is crucial as AI becomes increasingly sophisticated and capable of mimicking human behavior.

How does the Orb Mini support the mission of the World project?

The Orb Mini supports the World project’s mission by fostering a scalable system for human verification that can empower millions globally with digital proof of identity, thus enhancing the integrity of interactions between humans and AI.

Is the Orb Mini connected to OpenAI’s projects?

While it remains unclear if the Orb Mini will integrate AI features or collaborate directly with OpenAI’s initiatives, its development falls under the broader vision that Sam Altman and his team promote for future technologies related to human verification.

What is the significance of the 26 million registered users in relation to the Orb Mini device?

The 26 million registered users reflect the growing demand for human verification solutions like the Orb Mini. This substantial community demonstrates the project’s acceptance and the importance of mobile verification technology in distinguishing human identities in a digital age.

| Key Features | Description |

|---|---|

| Device Name | Orb Mini |

| Purpose | Verify if users are human or AI agents |

| Design | Resembles a smartphone with two front-facing cameras |

| Technology Used | Eyeball scanning to create a unique blockchain identifier |

| Launch Date | April 30, 2025 |

| Target Market | Initial focus on the U.S., following a strong presence in Latin America and Asia |

| Company behind the device | Tools for Humanity |

Summary

Mobile verification devices like the Orb Mini are revolutionizing how we confirm human identity in an increasingly AI-driven world. Unveiled by Tools for Humanity, the Orb Mini serves as a crucial tool to help differentiate between human users and AI agents, providing secure, blockchain-based verification through unique eyeball scans. This innovative technology aims to increase trust and authenticity online, addressing concerns that blur the lines between human interactions and AI engagements. As the project scales, including expansion efforts in the U.S., the role of devices like the Orb Mini will be pivotal in shaping future digital identity verification methods.

Understanding the Importance of Mobile Verification Devices in Today’s Digital Age

In an era where artificial intelligence is rapidly evolving, the differentiation between human and AI agents has become increasingly critical. Mobile verification devices, such as the recently unveiled Orb Mini by Tools for Humanity, serve an essential role in addressing this challenge. These devices leverage biometric data to confirm a user’s identity, providing a necessary tool for maintaining security and authenticity in digital interactions. By embodying the latest advancements in technology, mobile verification devices are not just tools; they are safeguards against the potential misuse of AI impersonation.

The need for mobile verification devices is amplified by the emergence of sophisticated AI applications that can convincingly imitate human behavior. This raises concerns about trust in online environments, from social media platforms to financial transactions. As tools like the Orb Mini become more prevalent, they will provide users the confidence that they are interacting with actual humans, rather than advanced AI systems. By introducing innovative methods for identity verification, such technologies play a crucial role in safeguarding personal data and enhancing overall online trust.

The Role of Sam Altman in Advancing Human Verification Technologies

Sam Altman, as a co-founder of Tools for Humanity and the World project, has significantly advanced the landscape of human verification through innovative technology. Altman’s vision, which focuses on creating digital ‘proof of human’ methodologies, reflects a commitment to navigate the complexities of human and AI interactions. His leadership in the startup ecosystem, particularly with the introduction of products like the Orb Mini, signifies a proactive approach to address the challenges posed by AI advancements. Altman’s influence extends beyond mere development; he aims to shape ethical standards and establish trust within an increasingly AI-dominated world.

Under Altman’s guidance, Tools for Humanity has positioned itself at the forefront of AI human verification solutions. The emphasis on utilizing biometric scanning, such as through the Orb Mini, demonstrates a commitment to integrating cutting-edge technology with practical applications. This initiative not only strives to enhance user experience but also pursues the broader goal of ensuring that technology serves humanity’s best interests. As a leader in the tech industry, Altman’s role is pivotal in charting the future of how society interacts with AI technologies, fostering a culture of accountability and transparency.

Exploring the Features of the Orb Mini Mobile Device

The Orb Mini, developed by Tools for Humanity, features advanced technology designed specifically for human verification. Resembling a sleek smartphone, the device utilizes dual front-facing cameras capable of scanning users’ eyeballs to achieve accurate biometric identification. This innovation plays a crucial role in distinguishing human users from AI agents, underscoring the strategic focus of the World project. By providing a unique identifier stored securely on the blockchain, the Orb Mini enables individuals to assert their humanity in various digital contexts.

Despite its simplistic design akin to conventional smartphones, the Orb Mini represents a sophisticated leap forward in verification technology. Although its primary function is to authenticate users rather than facilitate traditional smartphone activities, having portability allows wider accessibility. As Tools for Humanity prepares to launch the Orb Mini into the U.S. market, the device promises to play an essential part in democratizing verification technology, paving the way for millions to securely participate in the growing digital economy.

The Launch of World Network: Connecting Users and Verification Devices

The launch of World Network by Tools for Humanity signifies a pivotal moment in expanding access to human verification technologies across the United States. With storefronts opening in key cities like Los Angeles and Miami, individuals will have the opportunity to experience the Orb Mini firsthand, getting their eyeballs scanned for secure biometric verification. This initiative is aimed not only at technology enthusiasts but also at the general public who may benefit from improved security and verification processes in their daily digital interactions.

As Tools for Humanity pushes forward with its expansion, the significance of onboarding millions of users into its verification ecosystem becomes evident. Incorporating tools like the Orb Mini into everyday life can empower individuals to navigate the online world safely. The strategic locations chosen for the rollout of World Network storefronts demonstrate a commitment to making verification accessible to a diverse demographic, highlighting the urgent need for anti-AI impersonation tools in the rapidly evolving digital landscape.

The Global Impact of the World Verification Project

The World project, initiated by Sam Altman and his team, has already registered over 26 million users, with 12 million verified globally. Such figures outline a significant global interest in human verification systems and highlight the potential for mainstream adoption of technologies like the Orb Mini. As these initiatives gain traction, they could reshape how individuals perceive and interact with digital technologies, encouraging consumers to opt for verified interactions over potentially deceptive AI engagements.

The project’s continued expansion into regions like Latin America and Asia underscores the global necessity for reliable human verification methods. As AI technology advances, the ability to know whether a digital interaction involves a human or an AI agent is paramount for fostering trust in international digital ecosystems. The World project aims to bridge this gap and could set a precedent for similar verification initiatives that prioritize human oversight in the increasingly automated and AI-centric world.

Future Collaborations: The Potential Link Between Tools for Humanity and OpenAI

As Tools for Humanity expands its verification technologies, questions arise about potential collaborations with OpenAI—co-founded by Sam Altman. The intersection of human verification devices like the Orb Mini and advanced AI technologies suggests a possibility for unified innovations that enhance user experience while safeguarding interactions from AI impersonation. If such partnerships materialize, there could be groundbreaking developments in how verification is delivered and optimized within AI frameworks.

Collaborating with OpenAI may not only enhance the functionality of the Orb Mini but also integrate AI capabilities effectively to improve user verification processes. This could lead to streamlined experiences where identity verification becomes more efficient, using AI to assist rather than replace human engagement. The synergy between human verification tools and AI could revolutionize how we establish trust and security in online environments, marking a transformative phase in the relationship between technology and society.

The Importance of Ethical Considerations in AI Human Verification

As the industry of AI human verification continues to evolve, ethical considerations become paramount. Initiatives like the Orb Mini must navigate the delicate balance between innovation and user privacy. Tools for Humanity aims to ensure that the biometric data collected through devices is handled securely and ethically, preventing misuse and fostering trust among users. Protecting individual privacy while enabling technological advancements is a significant challenge that the organization seeks to address with responsibility.

Moreover, establishing transparent policies around data usage and user consent is crucial for the success of human verification technologies. As users become increasingly aware of their digital rights, organizations like Tools for Humanity need to adhere to strict ethical standards to maintain user trust. Ensuring that AI human verification methods prioritize user autonomy and data integrity will set a precedent for future technologies within the rapidly evolving digital landscape.

A New Era in Technology: The Implications of the World Project

The World project, led by Sam Altman, represents a technological shift towards recognizing and validating human presence within digital spaces. As AI capabilities expand, the implications of this project signal the necessity for solutions that ensure the integrity of human interactions online. By establishing reliable verification methods through devices like the Orb Mini, the initiative serves as a first line of defense against AI impersonation, promoting a culture rooted in authenticity.

At its core, the World project aims to redefine how we interact with AI and each other as technology continues to evolve. By emphasizing the importance of human verification, Tools for Humanity not only addresses the immediate concerns of AI impersonation but also sets the stage for a more trustworthy digital future. As this technology becomes more widespread, it could cultivate a societal shift towards valuing and prioritizing genuine human connections in the digital realm.

Looking Ahead: The Future of AI and Human Verification Technologies

The future of AI and human verification technologies appears promising, especially with the advancements seen in devices like the Orb Mini. As more users become familiar and comfortable with biometric verification methods, the potential for broader acceptance and integration into everyday life grows. The balance of AI technology and human verification could redefine user interactions in the digital landscape, encouraging a new standard for secure online experiences.

Continued innovation in this field will likely lead to enhanced versions of existing technologies, integrating advanced algorithms and improved user interfaces. Collaboration between startups like Tools for Humanity and established tech giants could accelerate this progress, paving the way for comprehensive solutions that address the complexities of distinguishing between humans and AI. As we look to the future, the focus on ethical practices and user-centric design will be essential in fostering an ecosystem where trust, safety, and authenticity are paramount.

Technology

Meta Generative AI Revenue Forecast: $1.4 Trillion by 2035

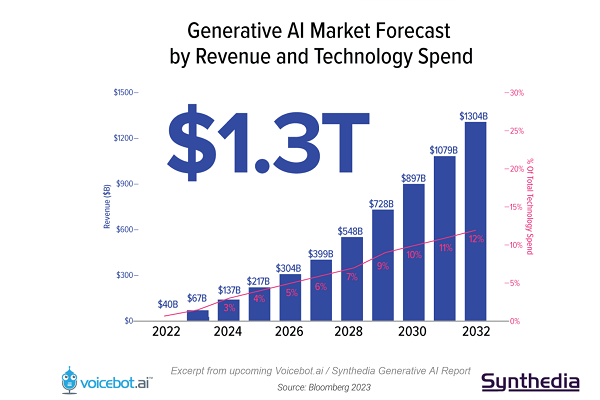

Meta generative AI revenue is set to be a game-changer as the tech giant anticipates a staggering forecast of $1.4 trillion by 2035.With estimates ranging from $2 billion to $3 billion in 2025, followed by projections skyrocketing to hundreds of billions, Meta’s strategic investments in artificial intelligence, particularly through its diverse AI product offerings, are making waves in the industry.

Meta generative AI revenue is set to be a game-changer as the tech giant anticipates a staggering forecast of $1.4 trillion by 2035. With estimates ranging from $2 billion to $3 billion in 2025, followed by projections skyrocketing to hundreds of billions, Meta’s strategic investments in artificial intelligence, particularly through its diverse AI product offerings, are making waves in the industry. The unsealed court documents reveal that these generative AI products, which include the innovative Meta Llama collection, are at the forefront of their revenue strategy. CEO Mark Zuckerberg has emphasized the potential for Meta’s AI tools to evolve, hinting at future monetization through ads and subscription services. As AI revenue forecasts continue to soar, Meta’s commitment to pushing the boundaries of AI technology positions it as a leader in this transformative field.

The revenue generated by Meta’s cutting-edge generative AI technologies highlights the company’s significant pivot towards artificial intelligence solutions. This involves a comprehensive suite of AI products set to reshape how users interact with digital platforms. In light of upcoming AI revenue projections, it’s clear that the Meta AI ecosystem will further expand, presenting unique monetization opportunities. With the Meta Llama collection serving as a foundation for innovation, its results could influence broader market trends. As the landscape of AI continues to evolve, Mark Zuckerberg’s vision for an integrated AI experience suggests a future rich with possibilities for both developers and end users alike.

Frequently Asked Questions

What is the forecast for Meta generative AI revenue by 2035?

Meta generative AI revenue is forecasted to reach between $460 billion and $1.4 trillion by the year 2035, highlighting the company’s significant growth potential in the AI sector.

What are Meta’s revenue predictions for generative AI products in 2025?

Meta anticipates that its generative AI products will generate between $2 billion and $3 billion in revenue by 2025, reflecting the company’s commitment to expanding its offerings in AI.

How is Meta generating revenue from its Llama collection?

Meta is generating revenue from its Llama collection of models through revenue-sharing agreements with partner companies and by offering an API for customization and evaluation of the Llama models, enhancing monetization options.

What investments is Meta making in its generative AI divisions?

Meta is making substantial investments in its generative AI divisions, with the budget for the ‘GenAI’ division exceeding $900 million in 2024 and expected to surpass $1 billion later this year, indicating a strong focus on AI development.

How does Mark Zuckerberg envision AI impacting Meta’s revenue?

Mark Zuckerberg has indicated that Meta AI could include features such as advertising and subscription plans, which may contribute significantly to the company’s revenue from its generative AI products in the future.

What are the implications of the lawsuit on Meta’s AI revenue forecasts?

The lawsuit regarding copyright infringement could influence Meta’s AI revenue forecasts, especially concerning the costs associated with licensing training data, which may impact their predicted revenue streams from generative AI.

How much is Meta’s capital expenditure aimed at AI development?

Meta’s capital expenditures for 2025 are projected to range between $60 billion and $80 billion, primarily focused on building new data centers that will support their generative AI initiatives.

What strategies is Meta using to acquire training data for its AI models?

Meta has been exploring various strategies for acquiring training data, including large-scale purchases of eBooks, although some methods have raised ethical questions amid ongoing legal challenges.

Why is generative AI revenue important for Meta?

Generative AI revenue is crucial for Meta as it represents a key growth area that could potentially lead to significant financial returns and market leadership in the rapidly evolving AI industry.

| Key Points |

|---|

| Meta forecasts $1.4 trillion in generative AI revenue by 2035. |

| In 2025, expected revenue from generative AI is between $2 billion and $3 billion. |

| Generative AI products definition remains unclear, but various revenue streams exist. |

| Meta has revenue-sharing agreements and launched a customizable Llama models API. |

| Significant investment in AI, with expected GenAI division budget over $1 billion. |

| 2025 capital expenditures estimated at $60-$80 billion for data center construction. |

| Meta considered $200 million for training data, including $100 million for books. |

| Reports indicate unauthorized acquisition methods for eBooks used in training. |

Summary

Meta generative AI revenue is a pivotal topic as the company aims to generate a staggering $1.4 trillion by 2035. This projection reflects the growing trend and potential profitability of generative AI technologies in today’s digital landscape. Amid ongoing legal challenges regarding copyright issues, Meta’s investments and plans reveal a strategic approach to harnessing generative AI’s economic possibilities while navigating the complexities of the tech industry.

Meta’s Generative AI Revenue Forecasts

Meta’s ambitious forecasts for its generative AI revenue position it at the cutting edge of the AI technology sector. The company anticipates generating between $2 billion and $3 billion by 2025, with a staggering potential growth to between $460 billion and $1.4 trillion by 2035. These projections highlight how generative AI technologies are becoming integral to Meta’s revenue streams, introducing innovative applications and services that could redefine user interactions online. As the demand for AI-driven solutions grows, so does the potential for Meta to capitalize on this trend, especially as generative AI continues to advance.

Moreover, the court documents that revealed these forecasts provide a glimpse into the substantial investments Meta is making in its AI product divisions. With over $900 million allocated to the ‘GenAI’ division this year, and expectations of surpassing $1 billion in funding, Meta is clearly dedicated to not just generating revenue but also to innovating and expanding its AI capabilities. This investment is essential as it supports ongoing development, the training of models, and the infrastructure required to maintain such advanced technologies.

Exploring Meta’s AI Products

Meta has established a diverse range of products that leverage generative AI, although the specific definitions of these products remain somewhat vague. One significant aspect of its AI strategy is centered around the Llama collection, a series of models designed to facilitate various applications. Meta has introduced revenue-sharing models with several companies utilizing these Llama models, indicating a collaborative approach that can foster innovation while generating income. This move not only enhances Meta’s service offerings but also engages a broader user base, allowing developers to create customized applications tailored to user needs.

In addition to its Llama models, Meta’s product portfolio includes AI-driven solutions that could potentially allow for personalized advertisements, as indicated by CEO Mark Zuckerberg during investor calls. This capability aligns perfectly with ongoing advancements in AI technologies. By harnessing the AI capabilities within its Meta AI assistant, the company could redefine how businesses approach marketing and user engagement, ultimately creating additional revenue streams through technology that learns and adapits to user preferences.

The Economic Impact of Meta’s AI Investments

Meta’s significant financial investment in AI products has profound implications for the broader tech economy. With projected capital expenditures ranging from $60 billion to $80 billion, primarily aimed at developing new data centers and related infrastructure, these expenditures demonstrate Meta’s commitment to being a leader in the AI domain. These investments not only fortify Meta’s capabilities but also elevate the entire ecosystem surrounding generative AI technologies. Businesses reliant on AI data centers will likely witness a surge in innovations and new applications, spurred by Meta’s advancements.

The anticipated growth of AI revenue forecasts, particularly in the generative AI sector, positions Meta as a key player in shaping future technological landscapes. As companies increasingly integrate AI into their business models, the demand for robust infrastructures to support such technologies will rise. Meta’s investments could inspire similar commitments from other tech giants and startups, fostering competition and accelerating the pace of innovation across the board.

Mark Zuckerberg’s Vision for AI

Mark Zuckerberg’s vision for AI reflects a deep understanding of how generative technologies can influence both business and consumer experiences. Through public statements and earnings calls, Zuckerberg emphasizes the necessity of investing in AI not just as a tool for operations but as a foundational aspect of Meta’s strategic growth. His outlook involves creating a future where Meta’s AI can provide more than basic functionalities; it envisions an ecosystem of smart analytics and personalized experiences that cater to individual user preferences.

Zuckerberg’s commitment to transparency about the company’s AI ambitions also suggests an eagerness to collaborate with other industry players. By articulating these goals, he paves the way for a dialogue on ethical AI practices, particularly in the context of navigating copyright issues and intellectual property rights as seen in recent lawsuits. This proactive approach highlights how Meta intends to redefine its generative AI products, ensuring they adhere to ethical standards while also capturing market share.

The Future of Generative AI at Meta

Looking toward the future, generative AI at Meta holds astonishing potential to shape the landscape of both technology and online interaction. The company’s strategic focus on expanding its AI models, particularly within the Llama collection, signals its dedication to remaining at the forefront of innovation. As technological advancements continue to unfold, these generative AI capabilities could reshape industries by enabling more personalized and efficient processes, thereby creating new opportunities for revenue generation.

Additionally, as Meta seeks to foster a collaborative ecosystem through revenue-sharing agreements and partnerships, it opens the door for developers and businesses to engage with its technologies meaningfully. This collaborative framework not only empowers third-party companies to leverage Meta’s advancements but also enhances the overall user experience. As Meta continues to innovate within the generative AI space, it may redefine the way businesses interact with technology, paving the way for a more integrated digital future.

Meta’s Commitment to Ethical AI Development

With the rapid advancement of generative AI technologies, ethical considerations have become paramount for Meta. The company faces scrutiny in light of lawsuits regarding the training of their AI on copyrighted materials. This has prompted discussions surrounding the importance of ethical AI development, including the need for transparent practices when it comes to data sourcing and user rights. Meta’s decisions on how they handle intellectual property and engagement with authors will likely set industry standards affecting future AI initiatives.

Furthermore, the integration of ethical paradigms into Meta’s AI strategy will not only safeguard the company from potential legal repercussions but also build trust with users and creators. As AI continues to evolve, the emphasis on responsible development will play a critical role in shaping public opinion and usage of AI technologies. Meta’s proactive stance on ethical practices could serve as a blueprint for other companies navigating similar challenges in the generative AI landscape.

The Role of Data Centers in AI Growth

The backbone of Meta’s generative AI growth is undoubtedly its extensive data center infrastructure. With current projections estimating capital expenditures between $60 billion and $80 billion for the next few years, these centers are crucial for training advanced AI models and hosting services efficiently. As demands for AI applications increase, the need for robust, scalable data centers that can handle massive datasets becomes imperative. This considerable investment ensures that Meta remains competitive in delivering cutting-edge AI products.

Additionally, the construction of new data centers will not only support Meta’s internal needs but can also pave the way for third-party developers who rely on similar infrastructures. As Meta expands its capabilities to host and train generative AI models, it creates a ripple effect throughout the market, encouraging innovation and providing the necessary resources for growing tech enterprises. Consequently, Meta’s data center investments might redefine the landscape in which AI technologies are developed and utilized.

The Importance of Collaboration in AI Development

Collaboration stands as a pivotal principle in the advancement of AI technologies, particularly as demonstrated by Meta’s strategic partnerships with other businesses. By establishing revenue-sharing agreements with companies that adopt the Llama collection, Meta fosters a cooperative environment that enhances innovation. This collaboration not only benefits Meta but also allows external developers to create more tailored applications, ultimately enriching the ecosystem of generative AI solutions available to consumers and businesses alike.

Furthermore, encouraging collaboration within the AI space can lead to a more diversified range of applications, building user engagement and trust in generative AI technologies. As developers leverage Meta’s models to create unique user experiences, the results can stimulate growth and market interest in Meta’s offerings. By prioritizing collaborative efforts, Meta could effectively navigate challenges posed by regulations and user expectations, ensuring that its generative AI developments are both innovative and acceptable.

Navigating Legal Challenges in AI Innovation

As the generative AI landscape evolves, navigating legal challenges becomes increasingly complex, especially for companies like Meta. The lawsuits regarding copyright infringement raise critical questions about the future of AI training practices and data sourcing. Meta’s approach to these legal challenges will likely influence how generative AI is developed and deployed, potentially leading to new guidelines and standards for the industry as a whole.

Moreover, addressing these legal issues proactively not only protects Meta from financial repercussions but also positions the company as a leader in responsible AI development. As greater scrutiny on data usage and intellectual property rights intensifies, Meta’s ability to develop ethical frameworks will be crucial in maintaining consumer trust and fostering positive relationships with creators. In this regard, their handling of these disputes could set any precedents for future practices across the tech industry.

Technology

Amazon Nova Premier: The Most Advanced AI Model Yet

Amazon Nova Premier has emerged as a groundbreaking addition to the company’s suite of AI technology, as announced recently.Representing the pinnacle of the Nova family of AI models, Nova Premier leverages Amazon Bedrock to deliver advanced functionalities across text, images, and videos, though it notably excludes audio processing.

Amazon Nova Premier has emerged as a groundbreaking addition to the company’s suite of AI technology, as announced recently. Representing the pinnacle of the Nova family of AI models, Nova Premier leverages Amazon Bedrock to deliver advanced functionalities across text, images, and videos, though it notably excludes audio processing. This innovative generative AI model is designed to tackle complex tasks requiring a rich understanding of context, extensive multi-step planning, and accurate execution through various integrated tools. With an impressive context length of 1 million tokens, Nova Premier can analyze approximately 750,000 words in one go, positioning it as a formidable contender in the AI landscape. Despite some performance discrepancies relative to leading competitors, its strengths in knowledge retrieval and visual understanding make it a powerful tool for developers and enterprises alike.

In recent developments, Amazon has rolled out its latest advanced artificial intelligence system, known as Nova Premier, which expands the capabilities of its AI model offerings. This cutting-edge solution, available through the Amazon Bedrock platform, excels in handling intricate tasks that necessitate a thorough grasp of contextual information. By incorporating generative AI functionalities, it can manage vast textual and visual data with remarkable efficiency. While certain benchmarks may highlight limitations compared to rival models, Nova Premier’s ability to process large quantities of information speaks volumes about its potential in enhancing the user experience and driving innovation. As the demand for sophisticated AI models continues to grow, Amazon’s advancements signal a significant evolution in intelligent computing.

Frequently Asked Questions

What is the Amazon Nova Premier AI model?

Amazon Nova Premier is the latest and most advanced addition to the Nova family of AI models, designed to process text, images, and videos with high efficiency. It is available on Amazon Bedrock, Amazon’s AI model development platform, and specializes in executing complex tasks that require a deep understanding of context and multi-step planning.

How does Amazon Nova Premier compare to other AI models?

While Amazon Nova Premier excels in knowledge retrieval and visual understanding, it underperforms in certain benchmarks compared to competing models from companies like Google. Notably, it scores lower on tests such as SWE-Bench Verified and math/science assessments, like GPQA Diamond.

What is the maximum context length for Amazon Nova Premier?

Amazon Nova Premier features an impressive context length of 1 million tokens, which allows it to analyze roughly 750,000 words at once. This extensive context length is critical for understanding and processing complex information effectively.

What are the pricing details for using Amazon Nova Premier on Bedrock?

The pricing for using Amazon Nova Premier on Amazon Bedrock is $2.50 per 1 million input tokens and $12.50 per 1 million output tokens. This pricing is comparable to other AI models like Google’s Gemini 2.5 Pro.

Can Amazon Nova Premier be used for reasoning tasks?

No, Amazon Nova Premier is not classified as a reasoning model. It does not have the capability to evaluate and fact-check responses to inquiries with the depth and precision of models like OpenAI’s o4-mini. Its strength lies in performing and teaching smaller models specific tasks.

What are the advantages of using Amazon Nova Premier for AI development?

Amazon Nova Premier is particularly beneficial for AI development because it can teach and distill capabilities into smaller, more efficient models. Its strength in handling complex tasks and visual understanding makes it a valuable tool for developers and researchers working with generative AI technologies.

How does Amazon Nova Premier support generative AI applications?

Amazon Nova Premier plays a central role in Amazon’s strategy to enhance generative AI applications. With over 1,000 applications in development and significant growth in AI revenue, Nova Premier is poised to facilitate advancements in generative AI technologies across various sectors.

What types of tasks can Amazon Nova Premier perform?

Amazon Nova Premier is capable of performing tasks that involve analyzing text, images, and video, focusing on complex problem solving and multi-step reasoning, though it does not handle audio. Its capabilities are particularly strong in knowledge retrieval and visual understanding.

How does Amazon perceive the role of AI technology in its future?

Amazon regards AI technology as a critical component of its growth strategy, with CEO Andy Jassy noting a significant increase in generative AI revenue and highlighting the development of numerous AI applications as a driver for future success.

| Key Feature | Details |

|---|---|

| Model Name | Nova Premier |

| Processing Capabilities | Text, Images, Videos (Not Audio) |

| Context Length | 1 million tokens (approximately 750,000 words) |

| Performance Areas | Excels in knowledge retrieval and visual understanding |

| Pricing | $2.50 per million input tokens; $12.50 per million output tokens |

| Limitations | Underperforms compared to competitors on certain benchmarks |

| Purpose | Optimal for teaching smaller models through distillation |